Erbium, yttrium, thulium – these metals, belonging to the "rare earth" elements, are vital to many modern technologies. Rare earths are not only required for the production of 3D printers, but are equally essential for the production of electric motors and wind turbines. Rare earth elements are not as "rare" as their name implies. The raw materials, a total of 17 chemical elements, even occur rather frequently in ores. In fact, what is hard to find, are larger and contiguous deposits, so whoever controls them has a clear advantage.

In the recent past, 90 % of rare earths had been mined at very low production cost in China, where they caused massive environmental hazard and pollution. In 2010, however, Beijing scrapped its quotas for rare earths exports. According to its government officials, China wants to "reorganize the market after years of exploitation, protect the environment and obtain a fair price for these valuable raw materials" – also with the aim of promoting further processing on its own territory. This change of direction has been accompanied by fatal consequences for the raw material processing industry abroad: after all, supply will become scarcer and prices will rise.

Entering alternative markets – Easier said than done

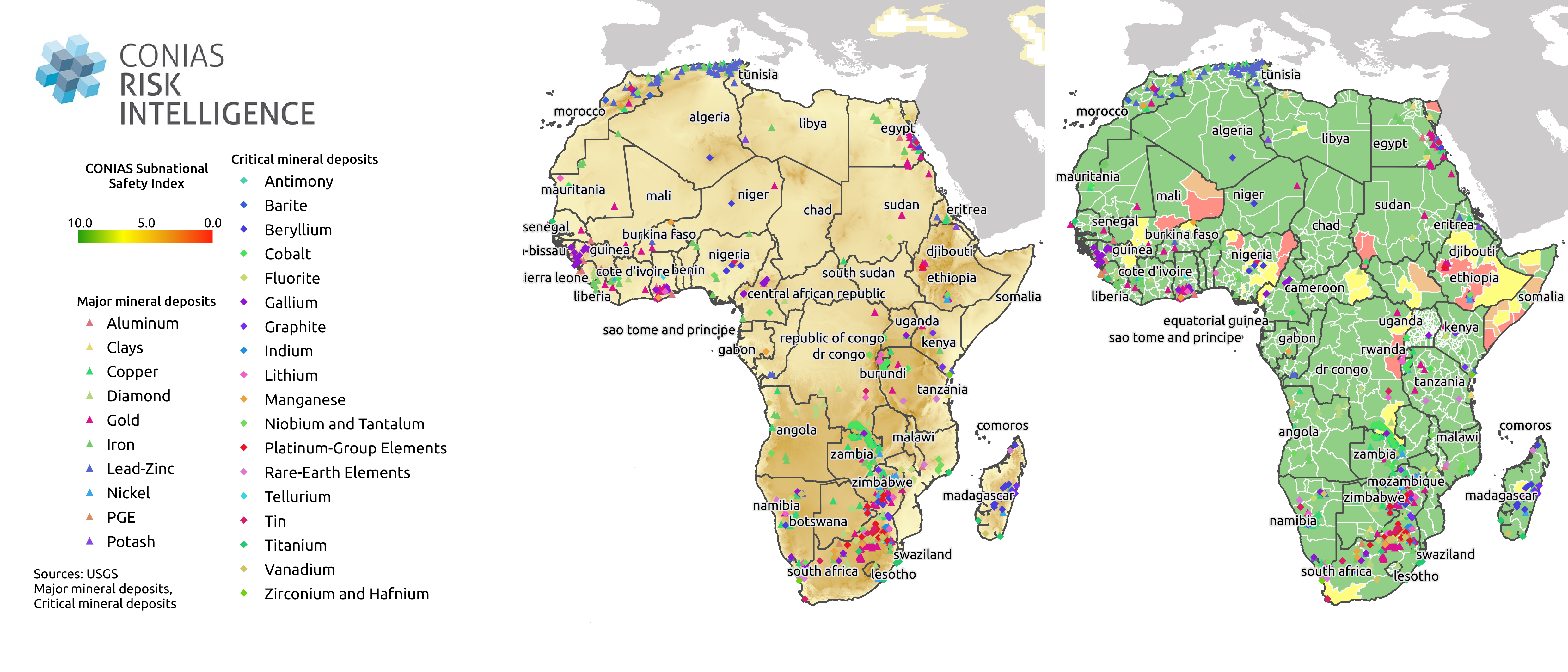

How can internationally operating companies react to this challenge and position themselves for the future? In order to ensure a sufficient supply of raw materials in the long term, they need to explore and enter new markets – but where? Large alternative extraction sites for rare earths are suspected on the African continent, where approximately half of all deposits of so-called carbonatites, in which the coveted metals are found, are estimated to be located. At first glance, relocating mining and production to Africa may seem promising, but in reality this poses a variety of challenges. Entering new raw material markets successfully also always requires the establishment of reliable supplier networks. However, as African suppliers are often located in areas where lower environmental and social standards are common, companies are faced with a variety of challenges. In a globalized world, strikes and environmental scandals affecting suppliers can tarnish also the reputation of their international partners. As the discussion about the Fairphone, for example, shows, customers are becoming increasingly interested in issues relating to material procurement and production conditions. Just recently, Glencore, the world's largest commodities trader, had become aware of this, as allegations of corruption and money laundering in the context of its African business led to a 10 percent drop in its shares. In general, companies operating in Africa are required to deal with highly complex supply chains, and have to ensure that they obtain critical information at the earliest stage possible. Although the rare earth metal tantalum, which is used in almost all mobile devices, is processed in China, one should be aware of the fact that it is mined in the Congo, in the Kivu region. A closer look at the mining conditions there reveals the sensitivity of this raw material market: the local mines are almost exclusively controlled or even run by rebel groups, which finance their activities in the Congolese civil war.

In addition to security risks for local employees and a potential reputation losses, companies also need to take into account recent regulations in their own home countries as well as in third states when they consider entering alternative raw material markets. European and US companies are particularly affected by increased regulation activity in this area. In 2010, for instance, the Dodd-Frank Act came into force in the US, which, among other things, regulates the mining of minerals in conflict areas and provides for reporting and disclosure obligations for listed US companies. German companies, who are part of their supplier network, may also be affected by the regulation and must declare the use of "conflict minerals", as the disclosure obligation affects the entire supply chain. Although the so-called conflict minerals tin, tantalum, gold or tungsten can still be used in the production process, companies must indicate whether they originate in the Democratic Republic of Congo (DRC) or neighbouring countries and submit a "Conflict Minerals Report" containing comprehensive information on the origin and use of the minerals to the US Securities and Exchange Commission.

By forcing companies to disclose the origin of certain raw materials, companies were, in line with the principle “naming and shaming”, supposed to be encouraged to distance themselves from mines that do not comply with environmental and social standards or are even involved in conflicts. However, the ambitious initiative has not yet been able to achieve this goal and has even been counterproductive in some cases. The complete disclosure for affected companies is accompanied by enormous bureaucratic efforts on their side, as for some, conflict-ridden mines must be identified in the first place. Hence, many companies choose the easier way and withdrew completely from business with the Congo. This hits especially those mines hard, that comply with environmental and social standards and create jobs for the Congolese population. So far, neither companies nor the Congolese extractive industry and population, have benefited from the Dodd-Frank Act.

Only proactive risk management is successful

In view of these difficulties, it is in the best interest of companies to engage in the field of sustainable supply chain management proactively instead of sitting recent and future challenges out. The aim should be to examine the entire value chain of a product, from the extraction of raw materials through the production process and sale to use and disposal. This review process should be examined through the lenses of economic, ecological and social criteria: moreover if possible, all negative side effects should be eliminated. What may initially involve some effort on the company’s side is nevertheless highly likely to be successful in the medium and long term.

Careful supplier selection helps enterprises to minimize risks in their supply chain and reduce, in the mid-term bureaucratic costs of making their business activities transparent to authorities and consumers. Credible efforts to reach sustainability already increase the attractiveness for future and current employees and improve the company’s global reputation and positive brand recognition. We are happy to advise you on how to enter sensitive future markets and offer solutions for supply chain management that will show you the right path between risks and business opportunities.

You travel, trade and invest internationally and want to know more about political risks? Subscribe to our Newsletter to stay up to date on global developments and company news or get in touch with us directly for tailor-made consulting and data solutions - we look forward to hearing from you!